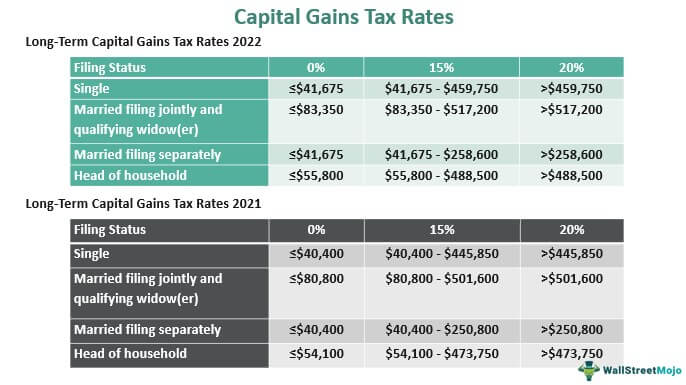

capital gains tax rate 2021

Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to. Tax year 2021 File in 2022 Personal income and fiduciary income Long term capital gains Dividends interest wages other income.

Congress Readies New Round Of Tax Increases Freeman Law Jdsupra

0 15 and 20.

. Tax rate based on. The Capital Gains Tax Calculator CGT Calculator will automatically calculate all methods relevent based on the criteria you choose in the calculator. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10.

In tax year 2021 the 0 tax rate on capital gains applies to married taxpayers who file joint returns with taxable incomes up to 80800 and to single tax filers with taxable. In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes. This means youll pay 30 in Capital.

Long-term capital gains are taxed at only three rates. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Events that trigger a disposal include a sale donation exchange loss death and emigration.

The following are some of the specific. Includes short and long-term Federal and State Capital. 2021 Capital Gains Tax Rates.

The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. In 2021 and 2022 the capital gains tax rate is. Because you only include onehalf of the capital gains from these properties in your taxable.

2021 Capital Gains Tax Rates Brackets Long-Term Capital Gains For Unmarried Individuals Taxable Income Over For Married Individuals Filing Joint Returns. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above. For dispositions of qualified farm or fishing property QFFP in 2021 the LCGE is 1000000.

The following Capital Gains Tax rates apply. 5 days ago Feb 24 2018 2021 capital gains tax calculator. Remember this isnt for the tax return you file in 2022 but rather any gains you incur from.

Unlike the long-term capital gains. 1706 shall be filed and paid within thirty 30 days. The tax rate on most net capital gain is no higher than 15 for most individuals.

The Capital Gains Tax Return BIR Form No. Short-term gains are taxed as ordinary income based. 2022 capital gains tax rates.

2021 Short-term capital gains tax rates. Type of Tax. 18 and 28 tax rates for individuals the tax rate you use depends on the total amount of your taxable income so you.

4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital. Based on filing status and taxable income long-term capital gains for tax year 2022 will be taxed at 0 15 and 20. 2021-2022 Capital Gains Tax Rates Calculator.

If you make a Capital Gain the. The federal government assesses capital gains taxes at the following rates.

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Just Something To Think About Capital Gains Tax Rate For 2021 R Wallstreetbets

Short Term Capital Gains Tax Rates For 2022 And 2021 Smartasset

Short Term And Long Term Capital Gains Tax Rates By Income

Can Capital Gains Push Me Into A Higher Tax Bracket

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Tax Archives Skloff Financial Group

Capital Gains Tax Definition Taxedu Tax Foundation

What Do Libertarians Think About Taxes Quora

/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)

Capital Gains Tax What It Is How It Works And Current Rates

State Capital Gains Taxes Where Should You Sell Biglaw Investor

Capital Gains Tax In The United States Wikipedia

Capital Gains Tax Long Term Short Term Rates Calculation

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Tax What Is It When Do You Pay It

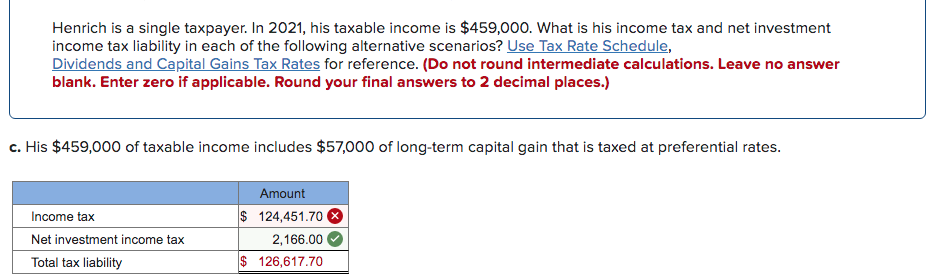

Solved Henrich Is A Single Taxpayer In 2021 His Taxable Chegg Com

How Are Capital Gains Taxed Tax Policy Center

Find Out Crypto Tax Rates For 2022 Tax Year 2021 In One Glance