michigan use tax act

Rendered Friday October 7 2022 Page 1 Michigan Compiled Laws Complete Through PA 188 of 2022 Courtesy of wwwlegislaturemigov III The price reduction or discount is identified as a third. CHAPTER 1 GENERAL PROVISIONS 141501 City income tax act.

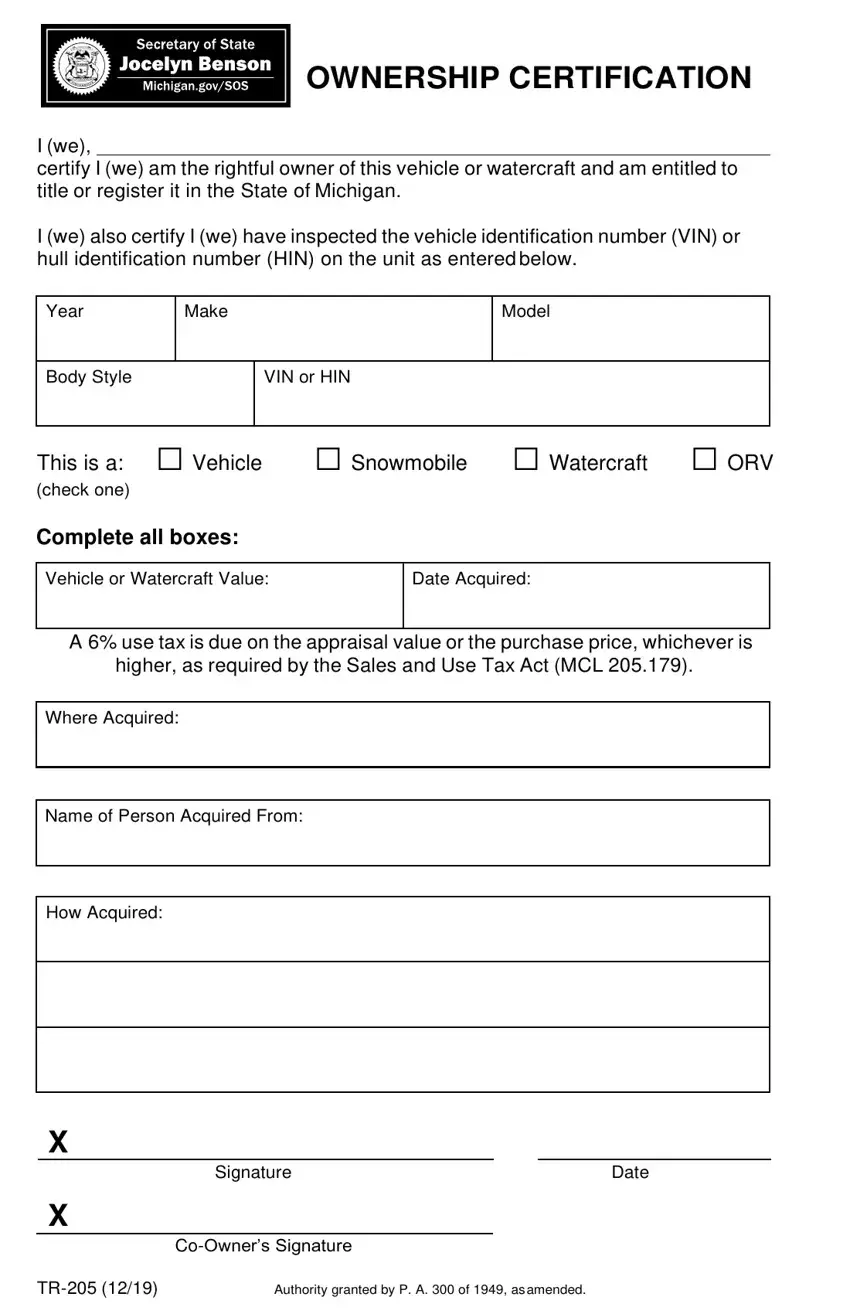

Michigan Tr 205 Form Fill Out Printable Pdf Forms Online

View the General Sales Tax Act 167 of 1933.

. The People of the State of Michigan enact. The People of the State of Michigan enact. 3 A credit against the tax levied under subsection 1 is allowed in.

Natural or artificial gas and home heating fuels for residential use are taxed at a 4 rate. The Michigan Use Tax Act imposes a tax for the privilege of using storing or consuming tangible personal property in this state MCL 205931. The People of the State of Michigan enact.

The Michigan use tax should be paid for items bought tax-free over the internet. Under any other exemption under the use tax act is exempt from the tax levied under subsection 1. USE TAX ACT Act 94 of 1937.

The Michigan Use Tax Act imposes a tax for the privilege of using storing or consuming tangible personal property in this state MCL 205931. 31 MCL 20593 provides. This act shall be known and may be cited as the city income.

GENERAL SALES TAX ACT Act 167 of 1933 AN ACT to provide for the raising of additional public revenue by prescribing certain specific taxes fees. Contractor is not liable for Michigan use tax on the materials it uses or consumes in performing this contract. Sales Tax Act and the Use Tax Act Acts to the construction industry generally and to contractors specifically.

However credit is given for any sales or use tax that had been legally due and paid in another state of the. Notice of New Sales Tax Requirements for Out-of-State Sellers. 20593a Tax for use or consumption.

MCL 20591 Use tax act. Streamlined Sales and Use Tax Project. Michigan does not allow city or local units to impose.

The People of the State of Michigan enact. The Michigan Use Tax Act imposes a tax for the privilege of using storing or consuming tangible personal property in this state MCL 205931. Act 167 of 1933.

USE TAX ACT Act 94 of 1937. The Michigan Use Tax Act Sec. The MI use tax only applies to certain purchases.

This act may be cited as the Use Tax Act. AN ACT to provide for the raising of additional public revenue by prescribing certain specific taxes fees and charges to be paid to the state. A contractor that acquires tangible personal property for an exempt use but then.

Charges for intrastate telecommunications services or telecommunications services between state and another state. Act 94 of 1937. Here in Michigan if you purchase tangible personal property for use in Michigan you have to either pay sales tax to the seller or pay whats called a use tax to the state.

AN ACT to provide for the levy assessment and collection of a specific excise tax on the storage use or consumption in this state of tangible personal property and certain. For transactions occurring on and after October 1 2015 an out-of-state seller may be. While the burden of paying.

This act shall be known and may be cited as the streamlined sales and use tax revenue equalization. 2022 Michigan state use tax. The Michigan use tax is a special excise tax assessed on property purchased for use in Michigan in a jurisdiction where a lower or no sales tax was collected on the purchase.

The People of the State of Michigan enact. USE TAX ACT Act 94 of 1937 AN ACT to provide for the levy assessment and collection of a specific excise tax on the storage use or. USE TAX ACT Act 94 of 1937 AN ACT to provide for the levy assessment and collection of a specific excise tax on the storage use or.

GENERAL SALES TAX ACT.

/cloudfront-us-east-1.images.arcpublishing.com/gray/KACIKBJ2SBP4NHLCVEWZSQOMQI.jpg)

Michigan Economist Says Us Tax Law Won T Cause State Taxes To Rise

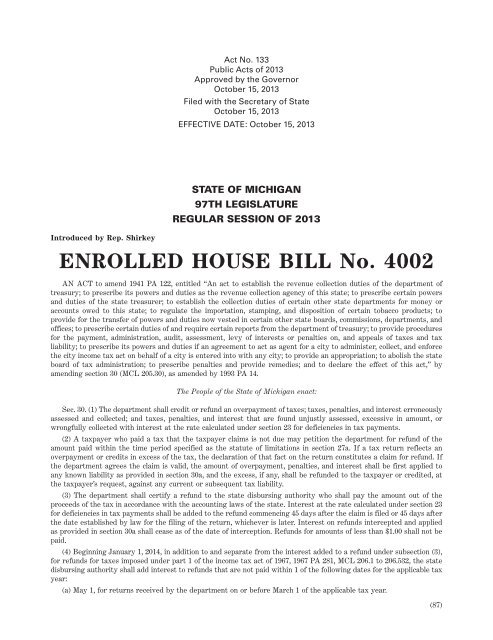

Enrolled House Bill No 4002 Michigan Legislature State Of

Sales Taxes In The United States Wikipedia

Michigan Tax Filers Could Face Id Quiz And Refund Delays

Michigan Enacts Salt Cap Workaround For Pass Through Entities Kerr Russell

Form 3372 Fill Out And Sign Printable Pdf Template Signnow

The Descent And Distribution Of Property Of Intestates Under The Laws Of Michigan With Leading Features Of The Inheritance Tax Law Walmart Com

Understanding Use Tax In Michigan Shindelrock

Michigan S New Internet Sales Tax Law Takes Effect Wdet 101 9 Fm

Revenue Administrative Bulletin 1995 3 State Of Michigan

Sales Tax Laws By State Ultimate Guide For Business Owners

Is Workers Comp Taxable Income In Michigan What You Need To Know

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

House Democrats Criticize Empty Legislative Calendar Housedems Com

Michigan Sales Tax Guide For Businesses

Mi Tr 205 2019 2022 Fill And Sign Printable Template Online Us Legal Forms

Communities In Michigan That Have Opted In To Adult Recreational Use